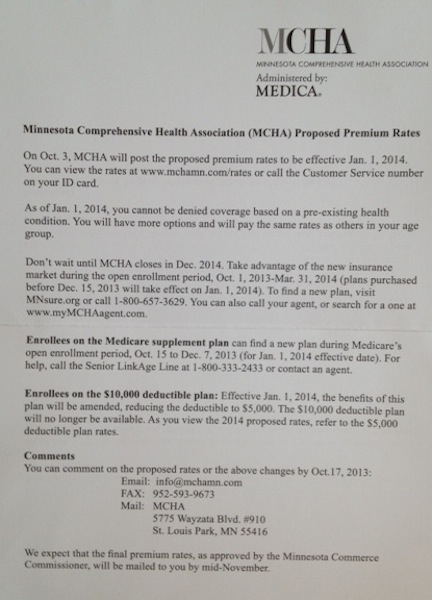

This is what a Junk Insurance policy cancellation notice looks like. I jumped for joy when I received mine. I believe that for a great majority of people who forced the noise machine chorus of “you promised I could keep my policy” that if they knew even a morsel of how our for-profit health care delivery system worked, they would have jumped for joy as well. (I still believe that President Obama was talking to people with employer-sponsored health plans when he made that statement. But then, that would require the populace to understand the difference between an employer-sponsored health care plan and individual Junk Insurance plans that most of the three million who received cancellation notices carry.)

Yipee!! My Junk Insurance cancellation notice. Onward to the ACA for real coverage and the start of a move to single payer.

I’ve written before about how I don’t have health insurance—I have bankruptcy insurance. That’s all about to change—in just over a month. Do you know what my now never-again-to-be-offered Junk Insurance plan covered? It basically covered NOTHING. I paid $329.21 per month for over two years and had a policy that covered a $25 flu shot once a year. Other than that, I paid for every visit to any medical professional, out of pocket, because my Junk Insurance policy carried a $10,000 deductible. I often wonder, does the U.S. populace understand what a “high deducible” policy even means?

My for-profit health insurance company forced me off my private policy several years ago after my diagnosis of breast cancer when they increased my monthly premium 20 percent for the two years after the diagnosis, making my monthly premium payment $705/month for a $5,000 deducible policy. (Yes, for-profit insurance companies have been raising rates forever when your policy due date arrives). Even at that, I was “luckier” than most people around the country because Minnesota has/had a “high risk” pool insurance group called the Minnesota Comprehensive Health Association (MCHA). What that basically meant was that anyone with a pre-existing condition who was denied insurance coverage (like me and my husband) and who had deep enough pockets and who basically didn’t need to see a medical professional, could get bankruptcy insurance. Yes, the $10,000 deductible policy that I no longer can purchase because of the Affordable Care Act (ACA)—did nothing more than provide a backstop for a bankruptcy if I had developed any major medical problem. It was Junk Insurance.

Minnesota continues to be one of the states leading the way in implementation of the ACA—even when it comes to cancellation notices. Take a closer look at what the notice tells me:

“Don’t wait until MCHA closes in December 2014. Take advantage of the new insurance market during the open enrollment period, Oct. 1, 2013-Mar. 31, 2014 (plans purchased before Dec. 15, 2013 will take effect on Jan. 1, 2014). To find a new plan, visit MNsure.org or call 1-900-657-3629. You can also call your agent, or search for one at www.myMCHAagent.com”

My Junk Insurance policy no longer available to me? I couldn’t be happier.

I will see my insurance broker on Tuesday December 2, 2013 to discuss my ACA options. Over the phone, she’s informed that she’s found plans (as did I when I went to MNSure) that could save my husband and me nearly $350/month on premiums. And you know what else? These ACA plans will actually cover preventative health procedures and they have deductibles we can meet without thinking bankruptcy.

Is it single payer (which is the only really answer to the chaos of our health care delivery system)? Nope. But for now, it’s what we have.